By Michael Phillips | Tech Bay News

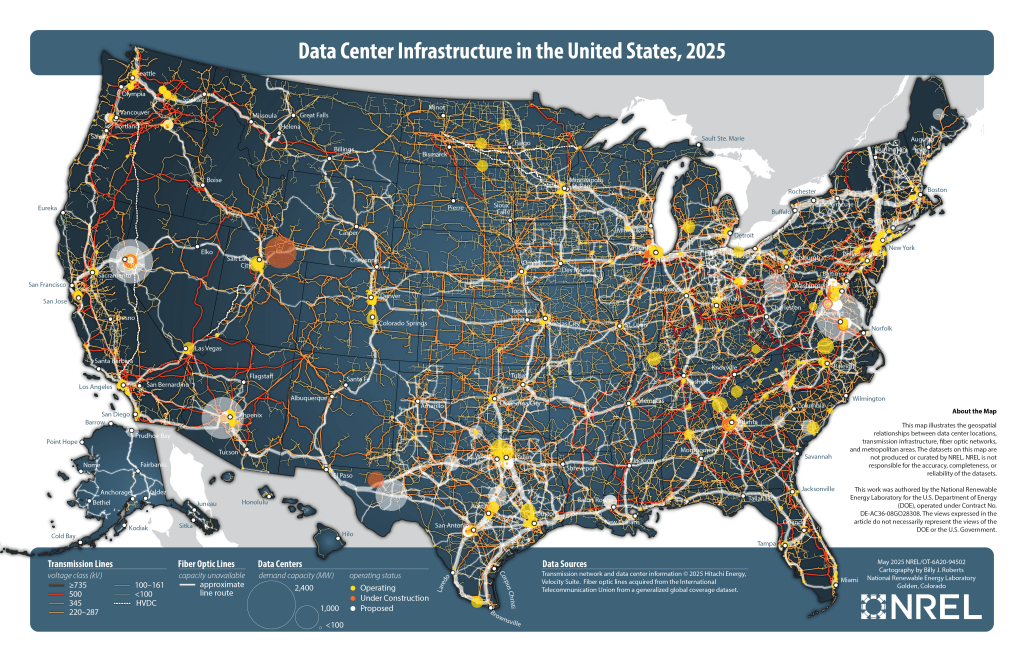

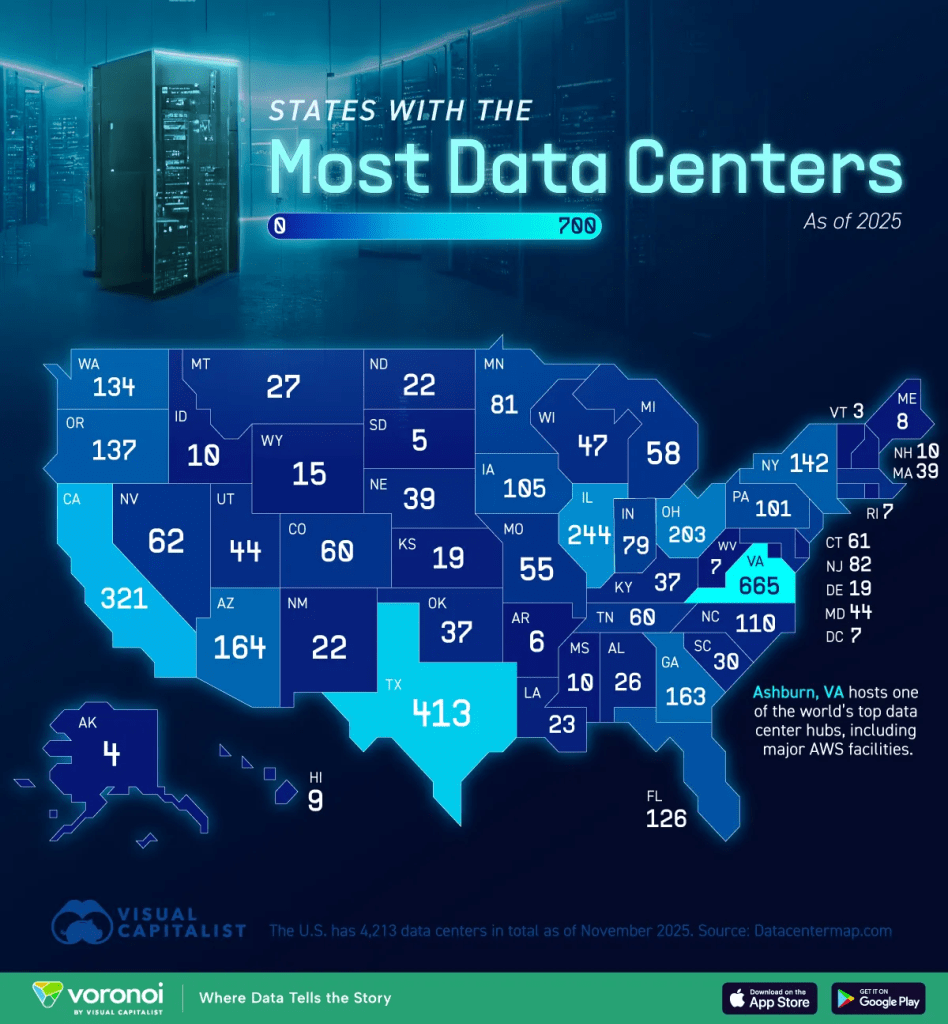

As artificial intelligence, cloud computing, and national security demands accelerate, data centers have quietly become one of the most important forms of infrastructure in the United States. By early 2026, the country hosts between roughly 3,700 and 5,400 operational data centers, depending on how narrowly or broadly facilities are defined. What matters more than the exact number, however, is where these facilities are concentrated—and where growth is now shifting.

Industry directories such as Baxtel, DataCenterMap, and Cloudscene paint a clear picture: America’s data center economy is dominated by a handful of states, with new growth increasingly pushed into secondary markets by power, land, and regulatory constraints.

The Top Data Center States (Early 2026)

Virginia remains the undisputed global leader, with roughly 670–680 facilities, overwhelmingly concentrated in Northern Virginia’s “Data Center Alley.” Loudoun County alone handles an estimated 70% of global internet traffic, making it one of the most strategically important digital corridors on Earth. But success has created limits: grid congestion and multi-year power delays are now slowing expansion.

Texas ranks second with approximately 430–570 facilities, driven by Dallas–Fort Worth and supported by abundant land, flexible power markets, and a pro-development regulatory climate. Unlike Virginia, Texas still has room to scale rapidly, and capacity additions are expected to surge through 2026.

California, with 290–320 data centers, remains essential thanks to Silicon Valley and Los Angeles. Yet energy constraints, permitting hurdles, and grid reliability issues have capped growth, pushing hyperscalers to look elsewhere for their largest new builds.

Oregon and Washington round out the Pacific Northwest cluster. Oregon’s 130–140 facilities, anchored in Hillsboro and Prineville, benefit from renewable energy and tax incentives, while Washington’s 120–130 sites focus on hyperscale campuses in Quincy and interconnection-heavy retail facilities near Seattle.

In the Southeast and Midwest, momentum is unmistakable:

- Georgia (160–170), powered by Atlanta’s connectivity and aggressive expansion pipeline

- Illinois (150–200), anchored by Chicago’s role as a national interconnection hub

- New York (100–150), focused on the broader NY–NJ metro region

- Arizona (100–120), where Phoenix has emerged as one of the fastest-growing hyperscale markets

- Ohio (80–100), rapidly rising due to power availability and favorable siting conditions

Most other states now host at least several dozen facilities, while sparsely populated states such as Wyoming, Vermont, and Alaska typically have fewer than ten.

Why Growth Is Shifting in 2026

The big story this year isn’t just where data centers already exist—it’s where new capacity is going.

Primary hubs like Northern Virginia and Silicon Valley are hitting hard limits. Grid upgrades can take five to seven years, and community backlash against massive power consumption has grown louder. As a result, developers are redirecting capital toward secondary and emerging markets that can deliver electricity faster and at scale.

States seeing the strongest relative growth in 2026 include:

- Ohio and Pennsylvania, benefiting from available transmission and industrial land

- Nevada, particularly Las Vegas and Reno, with explosive capacity growth projections

- North and South Carolina, along the I-85 corridor, offering incentives and power headroom

- Midwestern states like Indiana, Nebraska, and Wisconsin, increasingly attractive for AI workloads

Nationally, U.S. data center power demand is projected to rise from roughly 62 gigawatts in 2025 to about 76 gigawatts in 2026, with construction spending expected to jump around 25%. Importantly, growth is now measured less in facility counts and more in megawatts per campus, as hyperscale builds become larger, denser, and more energy-intensive.

A Strategic Infrastructure Question

From a center-right perspective, the takeaway is clear: data centers are no longer just a tech industry concern—they are critical national infrastructure. Power availability, permitting timelines, and regulatory predictability increasingly determine whether investment flows to a state or bypasses it entirely.

States that streamline grid expansion, respect property rights, and balance environmental goals with economic reality are winning the next wave of growth. Those that don’t risk watching billions in capital—and strategic digital capacity—move elsewhere.

In 2026, America’s digital backbone is still strongest where it was built first. But the future is being wired in new places, by states willing to treat data centers not as nuisances, but as the backbone of modern economic power.

Leave a comment