By Michael Phillips | Tech Bay News | MDBayNews

Maryland is no data center giant—but it is no longer an afterthought.

As of January 2026, the state hosts an estimated 39–45 operational data centers across roughly seven markets, primarily colocation and enterprise facilities. That places Maryland well behind national leaders like Virginia, Texas, and California, but recent growth has pushed it into a new category: a secondary hub benefiting from spillover demand driven by artificial intelligence, cloud computing, and Northern Virginia’s mounting constraints.

The question facing lawmakers and communities now is not whether Maryland will grow—but how.

Where the Growth Is Happening

Maryland’s data center footprint remains modest and fragmented, but several clear hubs have emerged:

- Frederick County has become the state’s most significant hyperscale hotspot, anchored by the massive Quantum Frederick campus on a former industrial site.

- Baltimore Metro hosts roughly 14 facilities, largely enterprise-focused, including established players like TierPoint.

- Prince George’s County has seen high-profile proposals, including redevelopment of the former Landover Mall.

- Secondary clusters in Beltsville, Laurel, Silver Spring, Rockville, and Glen Burnie benefit from proximity to Washington-area fiber and federal clients.

Maryland’s appeal is straightforward: proximity to Northern Virginia’s “Data Center Alley,” access to dense fiber routes and transatlantic cables, a skilled workforce near D.C., and lower exposure to earthquakes, wildfires, and hurricanes than many competing states.

Why Maryland Lagged—Until Now

Historically, Maryland missed the first wave.

Northern Virginia built its dominance decades ago with aggressive tax incentives, permissive zoning, and early power investments. Today, Loudoun County alone hosts 600+ data centers and handles a staggering share of global internet traffic.

Maryland, by contrast, faced:

- Tighter zoning and generator regulations

- Slower grid expansion within the PJM system

- Policy focus on other industries

Ironically, those constraints are now driving opportunity. As Virginia runs short on land and power, developers are increasingly looking north.

Incentives Fueling the New Push

Since 2020, Maryland has actively courted data centers through the Data Center Maryland Sales and Use Tax Exemption, offering:

- 10–20 years of equipment tax exemptions

- Lower thresholds in priority areas

- 20-year exemptions for projects exceeding $250 million

The state also passed the 2024 Critical Infrastructure Streamlining Act, easing backup generator permitting—one of the industry’s biggest regulatory pain points.

The result: proposals are flooding in from Frederick to Prince George’s County.

The Quantum Frederick Project: Scale Meets Scrutiny

The most consequential project is the Quantum Frederick campus, a master-planned, 2,100-acre redevelopment of the former Alcoa Eastalco Works aluminum plant near Adamstown and Buckeystown.

Originally launched by Quantum Loophole, the project is now fully controlled by TPG Real Estate following a 2024 settlement. Quantum Loophole no longer has an active role in the site, though it continues pursuing projects elsewhere.

Key facts:

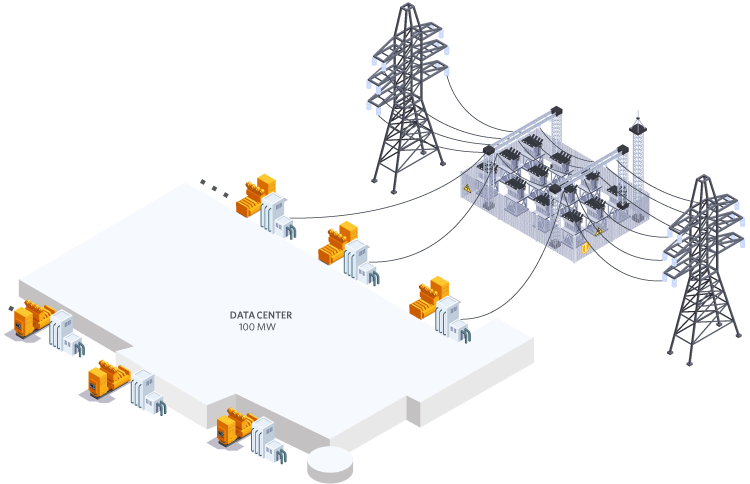

- Potential capacity: 2+ gigawatts, modular builds of 30–120 MW

- Connectivity: The QLoop fiber ring—over 235,000 strands—links Frederick to Ashburn with sub-1 ms latency, crossing the Potomac twice

- Power: Access to high-capacity transmission via Potomac Edison

- Tenants: Rowan Digital Infrastructure (Quinbrook-backed) advancing ~230+ MW phases

The campus includes a 600-acre nature reserve partnered with the University of Maryland, designed as a buffer, carbon sink, and stormwater system—an attempt to demonstrate “responsible” hyperscale development.

Still, the project has faced environmental violations, legal disputes, and fierce community opposition over power demand, noise, and farmland preservation. Initial operations are expected in 2026, with phased buildout stretching potentially to 2038.

The Economic Upside—and the Political Reality

Supporters argue data centers offer:

- Thousands of construction jobs

- Hundreds to thousands of permanent tech and operations roles

- Tens of millions annually in county and state tax revenue

- A partial offset to Maryland’s $1.4–$1.5 billion budget deficit

Critics counter that many costs are being socialized—especially energy.

The Grid Is the Bottleneck

Maryland operates within PJM Interconnection, and that system is under strain.

PJM forecasts:

- ~32 GW of new regional peak demand by 2030

- ~30 GW attributed to data centers

- A 5,100 MW jump in 2027–2028 forecasts alone

Recent capacity auctions cleared at record highs—$329–333 per MW-day—adding billions in regional costs. Those costs flow directly to ratepayers, with Maryland households already seeing monthly increases and warnings of steeper hikes by 2028 if nothing changes.

PJM itself warns that reliability margins could be razor-thin as early as summer 2026.

Bipartisan Backlash—and a Course Correction

Concerns have united unlikely allies.

In late 2025, lawmakers overrode a veto by Wes Moore to mandate a comprehensive statewide data center impact study, due in September 2026. Proposals already circulating include:

- Requiring large data centers to bring or fund their own power

- Curtailable service during grid emergencies

- Stricter zoning and sustainability standards

- Refined PJM forecasting to curb speculative load inflation

The political message is clear: Maryland wants growth—but not chaos.

Bottom Line

Maryland’s data center footprint remains small by national standards, but momentum is undeniable. With AI demand accelerating and Virginia hitting its limits, the state is positioned to become a key secondary hub in the Mid-Atlantic digital economy.

Whether that transition strengthens Maryland—or strains it—depends on decisions being made right now: how power is priced, who pays for infrastructure, and whether “responsible development” becomes policy rather than slogan.

2026 will be the year Maryland decides what kind of data center state it wants to be.

Leave a comment